Managing finances in Japan: Opening a bank account and sending money abroad

“How can I open a bank account in Japan as a foreigner? What’s the best way to send money back home without losing a fortune in fees?”

Many expats in Japan find themselves grappling with these questions. The good news is that with the right information and approach, managing your finances in Japan can be straightforward and cost-effective.

In this article, we’ll guide you through the process of opening a Japanese bank account as a foreigner, explore the most efficient ways to transfer money internationally, and provide essential tips for navigating the Japanese banking system. Whether you’re a new English teacher in Tokyo or an experienced expat looking to optimize your financial management, this guide will help you take control of your finances in Japan.

Opening a Bank Account in Japan for Foreigners

Understanding Japanese Banking Requirements

Essential Documents Needed

When opening a bank account in Japan as a foreigner, it’s crucial to be well-prepared with the necessary documentation. The most important document you’ll need is your residence card (在留カード, zairyu card). This card serves as proof of your legal status in Japan and is essential for most official procedures, including banking.

In addition to your residence card, you’ll typically need to provide:

- Your passport

- A valid visa with a duration of stay longer than 6 months

- Proof of address, such as a utility bill or your residence certificate (住民票, juminhyo)

- Your personal seal (印鑑, inkan) or signature

Some banks may also require additional documents, such as:

- Proof of employment or student status

- Your My Number card or notification (個人番号, kojin bangou)

Choosing the Right Bank for Your Needs

Selecting the right bank is a crucial step in your financial journey in Japan. As an expat, you’ll want to consider factors such as:

- English support: Some banks, like Shinsei Bank and SMBC Prestia, offer more extensive English-language services.

- International transfer options: If you frequently send money abroad, look for banks with competitive exchange rates and transfer fees.

- ATM accessibility: Consider banks with a wide network of ATMs or those that offer free withdrawals from other banks’ ATMs.

- Online and mobile banking: Check if the bank offers robust digital services, which can be especially helpful if you’re not fluent in Japanese.

- Minimum balance requirements: Some banks may require you to maintain a minimum balance to avoid fees.

Popular banks among expats include:

- Shinsei Bank: Known for its English services and free domestic ATM withdrawals

- SMBC Prestia: Offers comprehensive English support and international banking services

- Japan Post Bank: Has the largest ATM network in Japan

- Mizuho Bank: Provides a good balance of services and has many branches

Step-by-Step Guide to Opening an Account

Visiting a Bank Branch

- Prepare your documents: Gather all the necessary documents mentioned earlier.

- Choose a branch: Select a branch of your chosen bank, preferably one with English-speaking staff if needed.

- Visit during business hours: Most banks operate from 9 AM to 3 PM on weekdays. Avoid busy times like lunch hours or month-ends if possible.

- Fill out the application form: You’ll be given an application form to complete. Some banks may have English versions available.

- Provide your information: You’ll need to provide personal details, including your name, address, phone number, and occupation.

- Choose your services: Decide on the type of account (usually a savings account for starters) and any additional services like a cash card or online banking.

- Verification process: The bank staff will verify your documents and information.

- Initial deposit: Make your initial deposit if required.

- Receive your bank book and card: You’ll typically receive a bank book (通帳, tsuchou) immediately. Your cash card may be mailed to you later.

Online Banking Options

While most traditional Japanese banks require an in-person visit to open an account, some newer digital banks offer online account opening processes. These can be more convenient for expats, especially those with limited Japanese language skills. Some options include:

- Sony Bank: Offers an online application process with English support.

- Rakuten Bank: Provides a fully online application, though the interface is primarily in Japanese.

- PayPay Bank (formerly Japan Net Bank): Allows online applications and is foreigner-friendly.

When opening an account online, you’ll typically need to:

- Fill out an online application form

- Upload scans or photos of your required documents

- Verify your identity through a video call or by submitting additional documentation

- Wait for approval and receive your account details electronically

Common Challenges Faced by Foreigners

While opening a bank account in Japan has become easier for foreigners in recent years, you may still encounter some challenges:

- Language barrier: Not all banks have English-speaking staff or English documentation.

- Visa restrictions: Some banks may not open accounts for those on short-term visas.

- Address requirements: You typically need a fixed address in Japan to open an account.

- Limited credit options: As a newcomer, you may have limited access to credit cards or loans initially.

- Cultural differences: Japanese banking practices may differ from what you’re accustomed to, such as the use of personal seals (inkan) instead of signatures.

- Technological gaps: Some Japanese banking systems may seem outdated compared to more digitally advanced countries.

To overcome these challenges, consider:

- Bringing a Japanese-speaking friend to assist with communication

- Researching foreigner-friendly banks beforehand

- Being patient and prepared with all necessary documents

- Familiarizing yourself with Japanese banking customs and etiquette

By understanding these requirements and potential challenges, you’ll be well-prepared to navigate the process of opening a bank account in Japan as a foreigner. Remember, while it may seem daunting at first, many expats successfully manage their finances in Japan every day. With the right preparation and approach, you’ll soon have a functional Japanese bank account to support your life in this fascinating country.

How to Make International Money Transfers from Japan

As an expat living in Japan, you may often need to transfer money internationally, whether it’s to pay bills back home, support family, or manage investments. Understanding your options and how to optimize your transfers can save you significant money over time.

Comparing Transfer Services

Bank Transfers vs. Online Transfer Services

When it comes to sending money abroad from Japan, you generally have two main options: traditional bank transfers and online money transfer services.

Traditional Bank Transfers: Japanese banks like MUFG, Mizuho, and SMBC offer international wire transfers. These are typically:

- Reliable and secure

- Suitable for large amounts

- Often more expensive due to higher fees and less favorable exchange rates

- Can be slower, sometimes taking 3-5 business days

Online Transfer Services: Popular options include TransferWise (now Wise), OFX, and PayPal. These services usually offer:

- More competitive exchange rates

- Lower fees, especially for smaller amounts

- Faster transfers, sometimes within 1-2 business days

- User-friendly interfaces, often with mobile apps

- The ability to set up transfers in advance or automate regular payments

The best choice depends on your specific needs, the amount you’re transferring, and the frequency of your transfers.

Evaluating Fees and Exchange Rates

When comparing services, it’s crucial to look at both fees and exchange rates:

Fees: These can include:

- Sending fees

- Receiving fees (sometimes charged by the recipient’s bank)

- Intermediary bank fees (for traditional bank transfers)

Exchange Rates: This is where many providers make their profit. Always compare the offered rate to the mid-market rate (which you can find on sites like XE.com or Google Finance).

To truly understand the cost of your transfer, calculate the total amount that will arrive in the recipient’s account after all fees and exchange rate margins are applied.

Tips for Reducing Transfer Costs

Timing Your Transfers

Exchange rates fluctuate constantly due to various economic and political factors. While it’s impossible to predict exact movements, you can potentially save money by:

- Monitoring rates: Use apps or set up alerts to track exchange rates.

- Understanding trends: Research factors that might affect the JPY and your target currency.

- Considering forward contracts: Some services allow you to lock in a rate for future transfers if you believe the rate is favorable.

Utilizing Promotional Offers

Many transfer services offer promotions to attract new customers or reward loyal ones:

- Sign-up bonuses: Some services offer fee-free transfers or better rates for your first transfer.

- Referral programs: You might get bonuses for referring friends to the service.

- Volume discounts: Some providers offer better rates or lower fees for larger transfers.

- Regular user perks: Frequent users might qualify for premium accounts with better terms.

Additional Tips:

- Batch transfers: If possible, combine smaller transfers into larger ones to potentially benefit from better rates and lower fees.

- Compare regularly: The best service for you might change over time as providers update their offerings.

- Consider multi-currency accounts: Some online services offer accounts that can hold multiple currencies, allowing you to transfer when rates are favorable.

By understanding your options and implementing these strategies, you can significantly reduce the cost of sending money abroad from Japan, ensuring more of your hard-earned yen reaches its intended destination.

Navigating the Japanese Banking System for Expats

As an expat in Japan, understanding the intricacies of the Japanese banking system is crucial for effective financial management. While it may seem daunting at first, with the right knowledge, you can navigate it smoothly and make the most of the services available.

Understanding Banking Fees and Charges

Common Fees to Watch Out For

Japanese banks typically charge various fees that might differ from what you’re accustomed to in your home country:

- Account Maintenance Fees: Some banks charge a monthly fee for maintaining your account, especially if your balance falls below a certain threshold.

- ATM Fees: Using ATMs outside of business hours or using ATMs from other banks often incurs fees. These can range from 100 to 220 yen per transaction.

- Transfer Fees: Domestic transfers between banks usually cost between 200 to 400 yen. International transfers can be significantly more expensive.

- Inactivity Fees: Some banks charge a fee if your account is dormant for an extended period, typically a year or more.

- Cash Card Reissuance Fee: If you lose your cash card, banks usually charge around 1,000 yen for a replacement.

How to Avoid Unnecessary Charges

To minimize banking costs in Japan:

- Maintain the minimum balance required by your bank to avoid account maintenance fees.

- Use your bank’s ATMs during business hours to avoid extra charges.

- Set up automatic transfers for regular payments to avoid repeated transfer fees.

- Use online banking for transfers when possible, as it’s often cheaper than in-branch services.

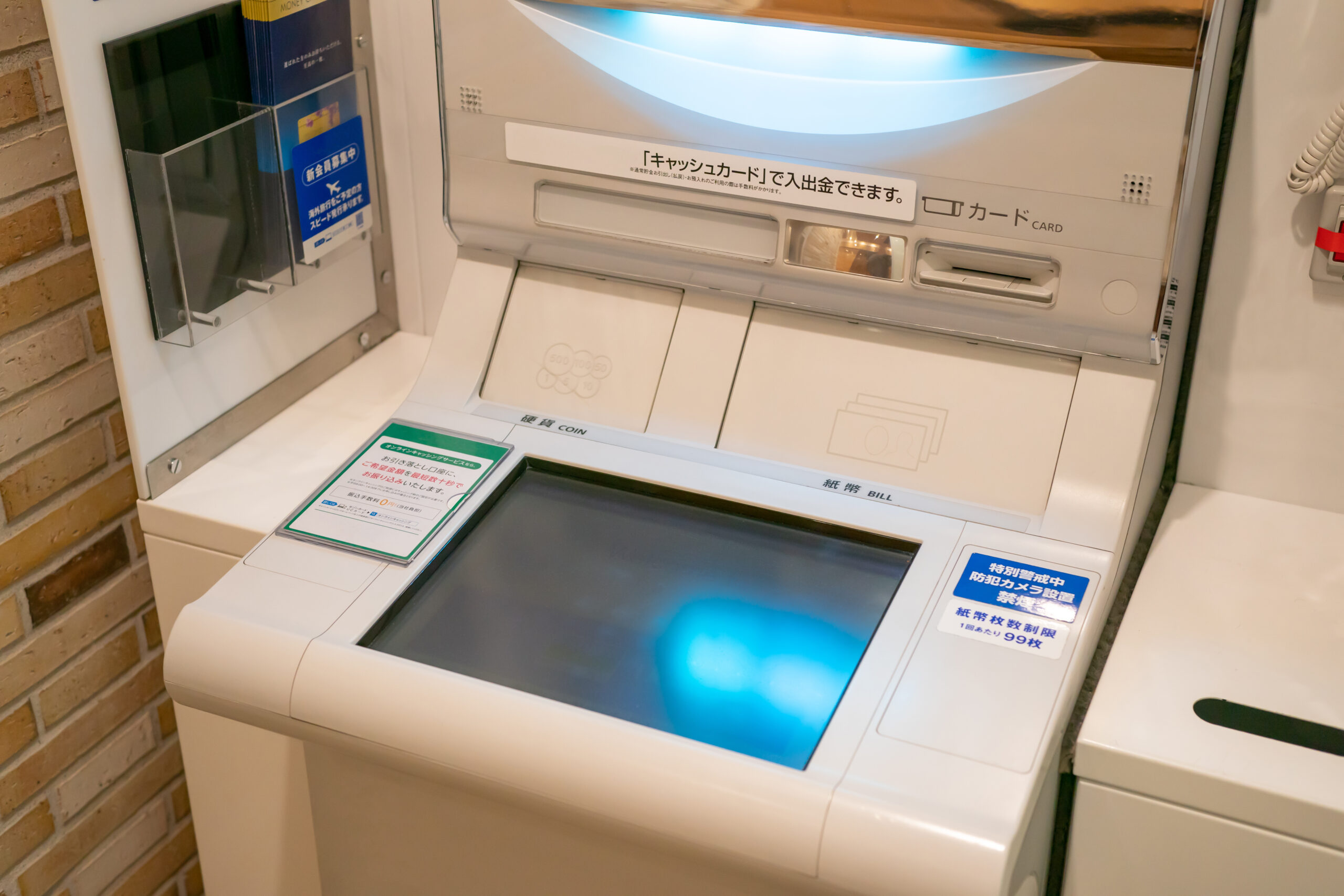

Utilizing Japanese ATM and Online Banking Services

ATM Networks and Access

Japan has an extensive ATM network, but there are some peculiarities to be aware of:

- Operating Hours: Many ATMs, especially those in banks, have limited operating hours. Some close as early as 5 or 6 PM and might not be available on weekends or holidays.

- Convenience Store ATMs: ATMs in convenience stores like 7-Eleven, Lawson, or FamilyMart often have extended hours and are foreigner-friendly.

- International Cards: Not all ATMs accept international cards. Look for ATMs with the “International ATM Service” sign, often found in post offices, 7-Eleven stores, and some major banks.

- Withdrawal Limits: Daily withdrawal limits are common, usually around 50,000 to 100,000 yen per day.

- IC Card Integration: Many Japanese bank cards now function as IC cards for small purchases, similar to contactless payment systems.

Setting Up Online Banking

Online banking in Japan has improved significantly in recent years, offering convenience for expats:

- Registration Process: You typically need to apply for online banking services separately after opening your account. This often involves receiving a password by mail.

- Security Measures: Japanese banks often use additional security measures like one-time passwords sent via SMS or generated by a physical device.

- Language Options: While many major banks now offer English interfaces for online banking, the depth of English support can vary.

- Mobile Apps: Most major banks offer smartphone apps for convenient banking on the go. These apps often have better English support than their web counterparts.

- Features: Common online banking features include account balance checks, domestic transfers, utility bill payments, and sometimes international transfers.

- Push Notifications: Many banking apps offer real-time notifications for transactions, helping you stay on top of your finances.

To make the most of online banking:

- Keep your login details and passwords secure.

- Familiarize yourself with your bank’s specific online platform.

- Set up automatic payments for regular bills to save time and avoid late fees.

- Regularly check your transaction history to monitor your spending and detect any unusual activity.

By understanding these aspects of the Japanese banking system, you can manage your finances more effectively, avoid unnecessary fees, and take advantage of the convenience offered by Japan’s banking infrastructure.

Conclusion and Key Takeaways

Navigating the Japanese banking system as an expat can seem daunting at first, but with the right knowledge and preparation, it becomes manageable. Remember to choose a bank that caters to your specific needs as a foreigner, be prepared with all necessary documents when opening an account, and familiarize yourself with the fees and services available. When making international transfers, compare options to find the most cost-effective method. Always be mindful of Japanese business etiquette in your banking interactions. By following these guidelines and continuously educating yourself about local financial practices, you’ll be well-equipped to manage your finances effectively during your stay in Japan.

Q&A About Opening a Japanese bank account and sending money abroad

What are the best banks for foreigners in Japan?

Shinsei Bank, SMBC Prestia, and Japan Post Bank are often recommended for their English services and foreigner-friendly policies. However, the best choice depends on your specific needs, location, and length of stay in Japan.

How long does it take to open a bank account in Japan?

Typically, if you have all the required documents, opening a bank account can be done in one visit, taking about 30 minutes to an hour. However, receiving your cash card and online banking details might take a few days to a week.

Are there any online-only banks suitable for expats?

Yes, banks like Sony Bank and Rakuten Bank offer online account opening processes that can be more convenient for expats. However, ensure you meet their specific requirements for foreign residents.

How often should I monitor exchange rates for money transfers?

If you’re making regular transfers, checking rates weekly is a good practice. For large, one-time transfers, you might want to monitor rates more closely for a month or two to find the best time to transfer.

What should I do if I encounter issues with my Japanese bank account?

First, try to resolve the issue with your local branch, preferably with an English-speaking staff member if available. If the problem persists, consider contacting the bank’s customer service line or seeking assistance from expat communities or your embassy for guidance.